Daily Market Analysis and Forex News

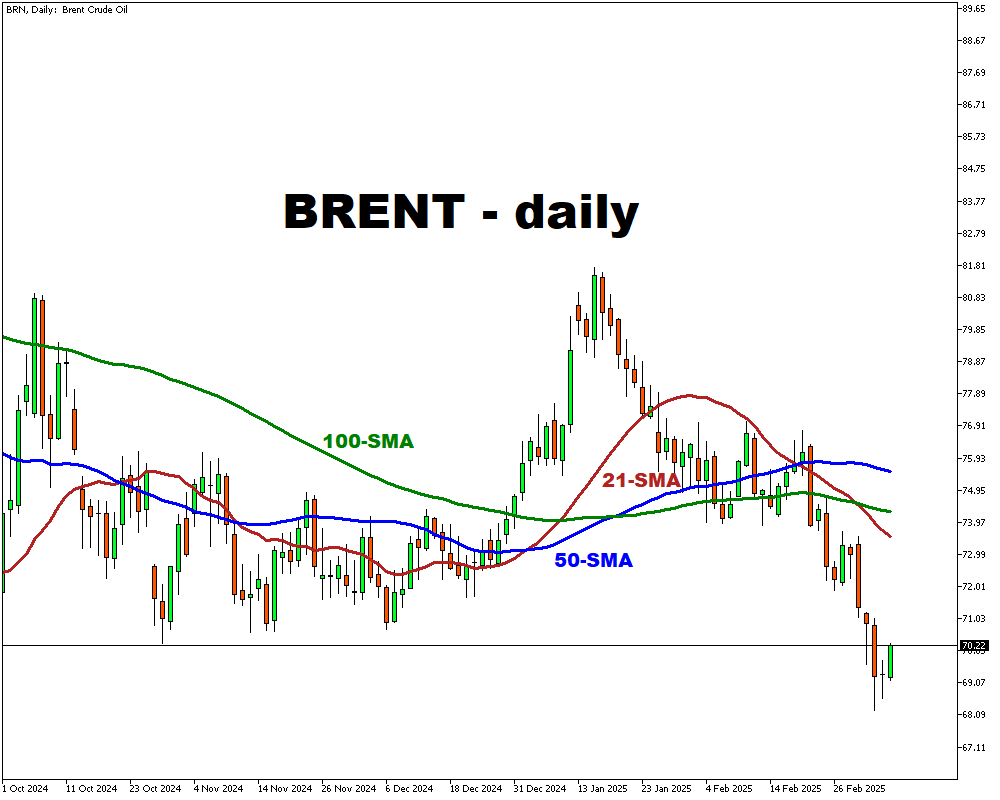

Brent is on track for a weekly loss

- Brent crude rises 0.40%, still down 3.28% weekly

- US trade uncertainty impacts oil market sentiment

- OPEC+ plans 138,000 bpd production increase in April

- Possible sanctions relief may boost Russian oil exports

Brent crude rose 0.40% to $70 per barrel on Friday, recovering slightly but still heading for a 3.28% weekly loss, the steepest decline since October.

The oil market has been under pressure due to uncertainty surrounding US trade policy, with President Trump delaying tariffs on Canada and Mexico but not fully resolving the issue.

Meanwhile, global supply concerns persist as OPEC+ moves forward with an April production increase of 138,000 barrels per day.

Additionally, bearish sentiment has been fueled by expectations of increased production from Kazakhstan's Tengiz field and the potential restart of the Kirkuk-Ceyhan pipeline.

The possibility of sanctions relief, potentially increasing Russian oil exports, has further contributed to market uncertainty.

Despite some support from U.S. measures targeting Iranian oil exports, Brent remains near four-month lows and vulnerable to further downside risk.

Ready to trade with real money?

Open accountGateway to global opportunity

Join more than 1 million traders worldwide using Alpari as a gateway to a better life.