Daily Market Analysis and Forex News

BRN may be on track for its first weekly gain since mid-January

- Brent crude rebounds, poised for its first weekly gain since mid-January

- Trump’s delay on retaliatory tariffs and OPEC+ quota compliance boost market sentiment

- Prices previously dropped to December lows due to eased supply risks and U.S. inventory builds

- IEA raises global oil demand forecast, narrowing the projected supply surplus

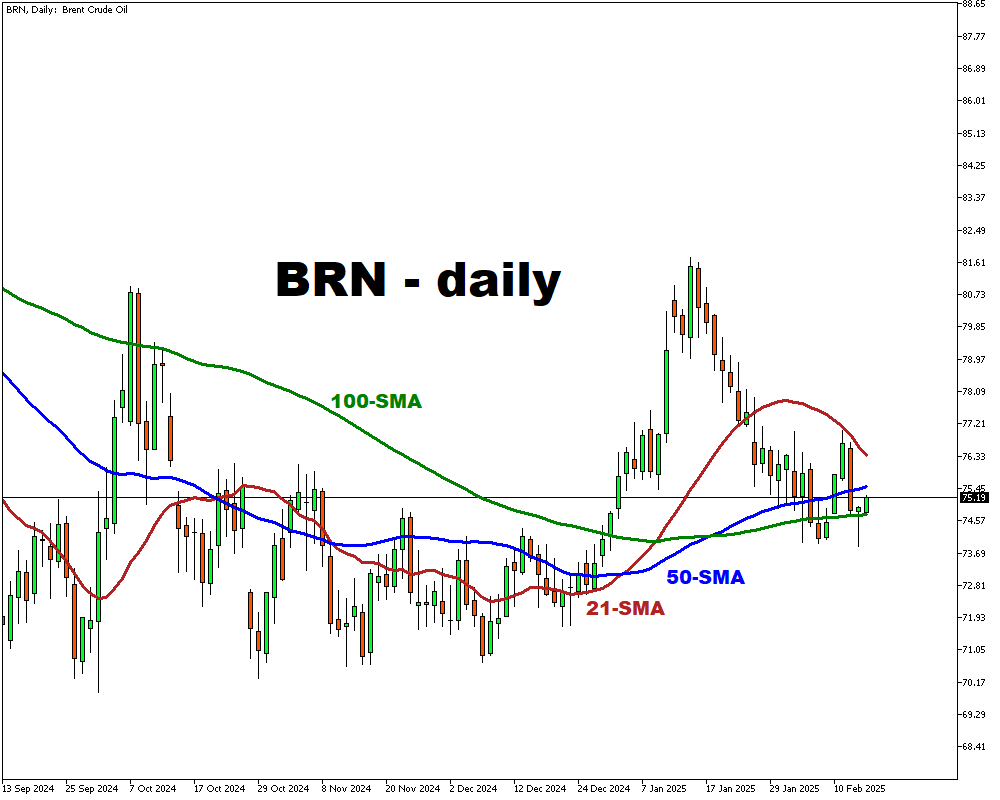

Brent crude may be on track for its first weekly gain since mid-January, currently holding above its 100-period SMA ($74.7), supported by Trump's decision to delay retaliatory tariffs on U.S. trading partners.

This rebound comes after the BRN fell (on Wednesday, February 12) to its lowest level since December, mainly due to reduced supply concerns and speculation over a possible Russia-Ukraine peace deal.

A rise in U.S. oil inventories added to the downward pressure on prices.

- API Crude Stock Change: 9.04 million – actual vs 2.8 million – forecast vs 5.03 million – previous

- EIA Crude Stock Change: 4.07million – actual vs 3.0 million – forecast vs 8.66 million – previous

However, the International Energy Agency (EIA) has raised its forecast for global oil demand, citing stronger compliance with production quotas by OPEC+ members.

This has helped to reduce the expected supply surplus.

BRN forecast (source: Bloomberg)

![]()

Ready to trade with real money?

Open accountGateway to global opportunity

Join more than 1 million traders worldwide using Alpari as a gateway to a better life.