Daily Market Analysis and Forex News

Week Ahead: Powell, OPEC+, and US jobs take focus

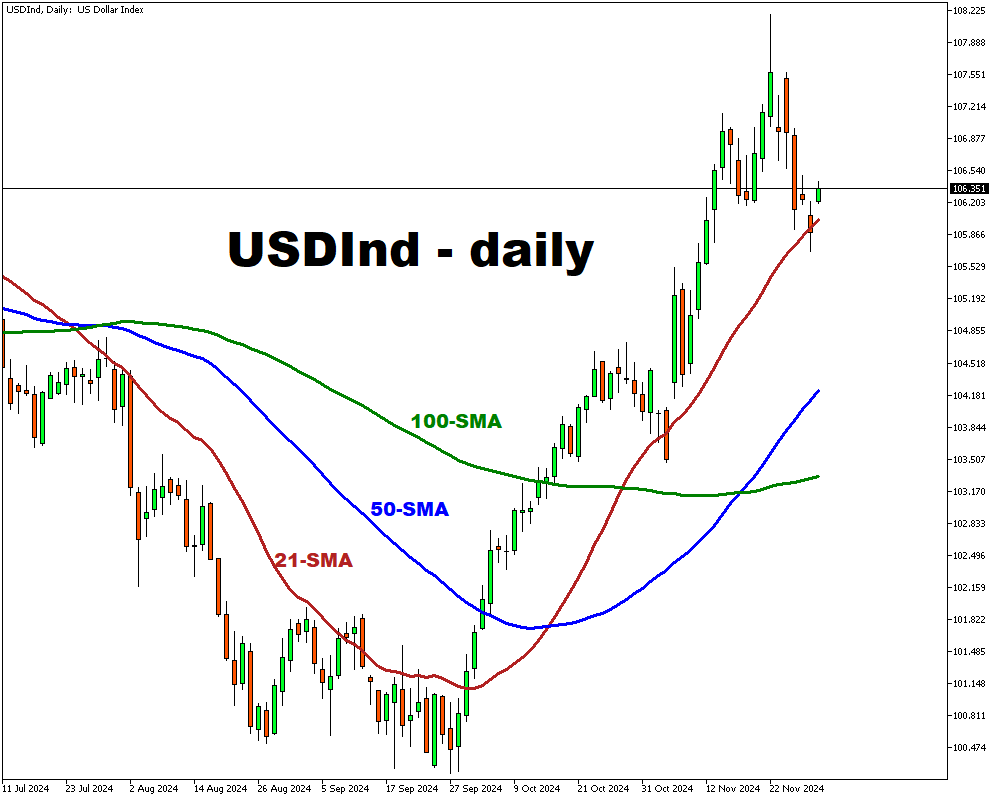

- Wednesday: Powell speaks; USDInd in focus

- Thursday: OPEC+ may delay output hike

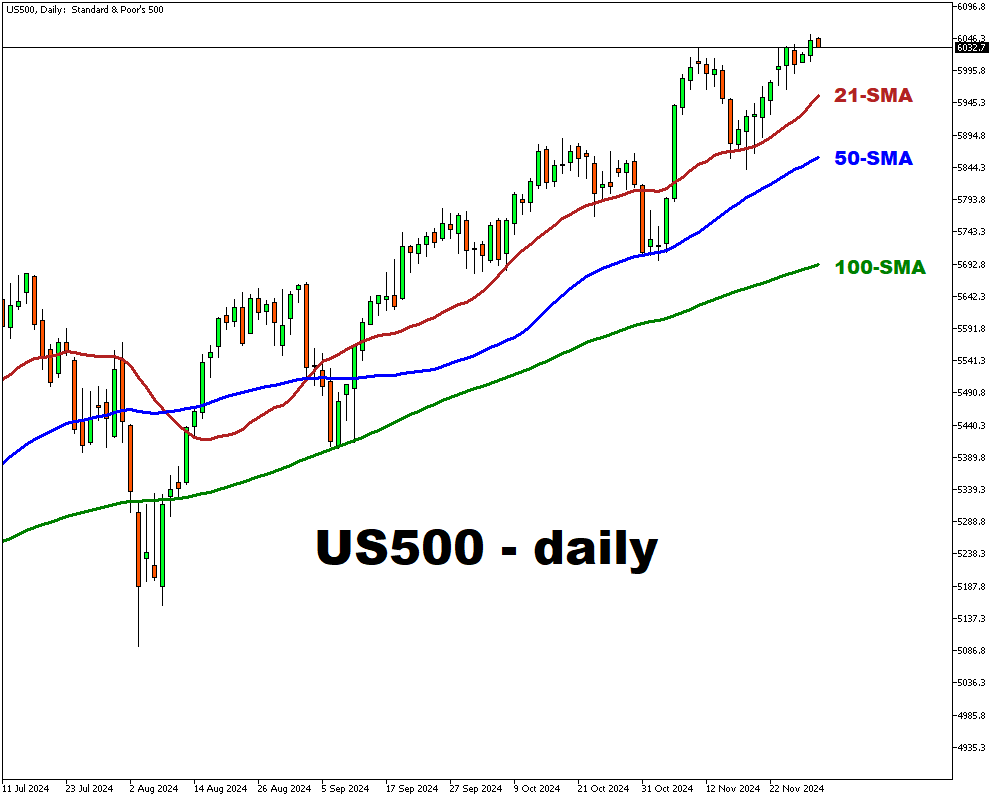

- Friday: US jobs report; US500 eyes 6,000

- Markets weigh Trump 2.0’s global impact

- Geopolitical tensions keep risks elevated

As we enter the final month of 2024, various asset classes are set to react to potential US policy signals stemming from Fed Chair Jerome Powell’s speech to the ever-important monthly US jobs report, and even the delayed OPEC+ decision on January’s output levels.

For the days ahead, we focus especially on the US dollar index (USDInd), Brent oil, and the benchmark US500 index.

Broadly, the coming week’s opportunities are set against a backdrop of expectations for Trump 2.0’s impact on the global economy, even as markets keep a wary eye on persistent geopolitical tensions.

Events Watchlist:

-

Wednesday, Dec 4th: Speech by Fed Chair Jerome Powell (USDInd)

Chair Powell’s speech comes in a week filled with “Fed speak”: at least 8 other Fed officials are due to make public remarks in the days before and after Powell. Should Powell and co. firm up expectations for a December rate cut, that could keep the US dollar index (USDInd) below its 21-day simple moving average.

-

Thursday, Dec 5th: OPEC+ meeting (Brent)

At this meeting, originally slated for Dec 1st, markets expect OPEC+ to delay yet again plans to raise output. Should this 23-member oil-producing alliance shock markets by press ahead with a production hike in January 2025, that could see Brent plummet and test the psychologically-important $70/bbl for immediate support.

-

Friday, Dec 6th: US November nonfarm payrolls report (US500 index)

Economists predict that the US economy added 200,000 new jobs in November, while the unemployment rate ticked up slightly to 4.2%. Notable signs of weakness in US hiring could briefly drag the US500 index below the psychological 6,000 level, though declines may prove limited, given the narrative that a weakening labour market would hasten more Fed rate cuts, in turn preserving the momentum for the US economy and equities.

Here’s a comprehensive list of other key economic data and events due this week:

Monday, December 2

- AU200 index: Australia November inflation; October retail sales

- CN50 index: China November manufacturing PMI

- EUR: Eurozone October unemployment rate

- SG20 index: Singapore November PMI

- US30 index: Speeches by New York Fed President John Williams and Fed Governor Christopher Waller

Tuesday, December 3

- AUD: Australia 3Q current account

- MXN: Mexico October unemployment

- US400 index: Speeches by Fed Governor Adriana Kugler and Chicago Fed President Austan Goolsbee

Wednesday, December 4

- AUD: Australia 3Q GDP

- SGD: Singapore November PMI

- CNH: China November composite and services PMIs

- EU50 index: Eurozone October PPI

- USDInd: Speeches by Fed Chair Jerome Powell and St. Louis Fed President Alberto Musalem; Fed Beige

Book

Thursday, December 5

- AUD: Australia October trade balance

- SG20 index: Singapore October retail sales

- EU50 index: Germany October factory orders; Eurozone October retail sales

- Brent: OPEC+ meeting (postponed from Dec. 1st)

- USDInd: US initially weekly jobless claims

Friday, December 6

- EUR: Eurozone 3Q GDP (final); Germany October industrial production and trade balance

- CAD: Canada November unemployment

- US500 index: US November nonfarm payrolls; US December consumer sentiment

- RUS2000 index: speeches by Fed Governor Michele Bowman, Cleveland Fed President Beth Hammack, Chicago Fed President Austal Goolsbee, and San Francisco Fed President Mary Daly

Ready to trade with real money?

Open accountGateway to global opportunity

Join more than 1 million traders worldwide using Alpari as a gateway to a better life.