Daily Market Analysis and Forex News

This Week: US30, CHINAH, GER40 and US500 are in focus

- Trump to speak before congress, March 4

- China’s National People’s Congress, March 5

- ECB rate decision may push GER40 to new highs

- US jobs data could drive US500 rebound

March 2025 is set to kick off with major events that could either fuel, or offer some reprieve, from the risk–off mode across global financial markets of late, considering rising fears of a global trade war.

Given the global ramifications of these upcoming events, we hand–picked 4 stock indexes – US30, CHINAH, GER40, and US500 – that may see outsized trading opportunities to kick off the new month.

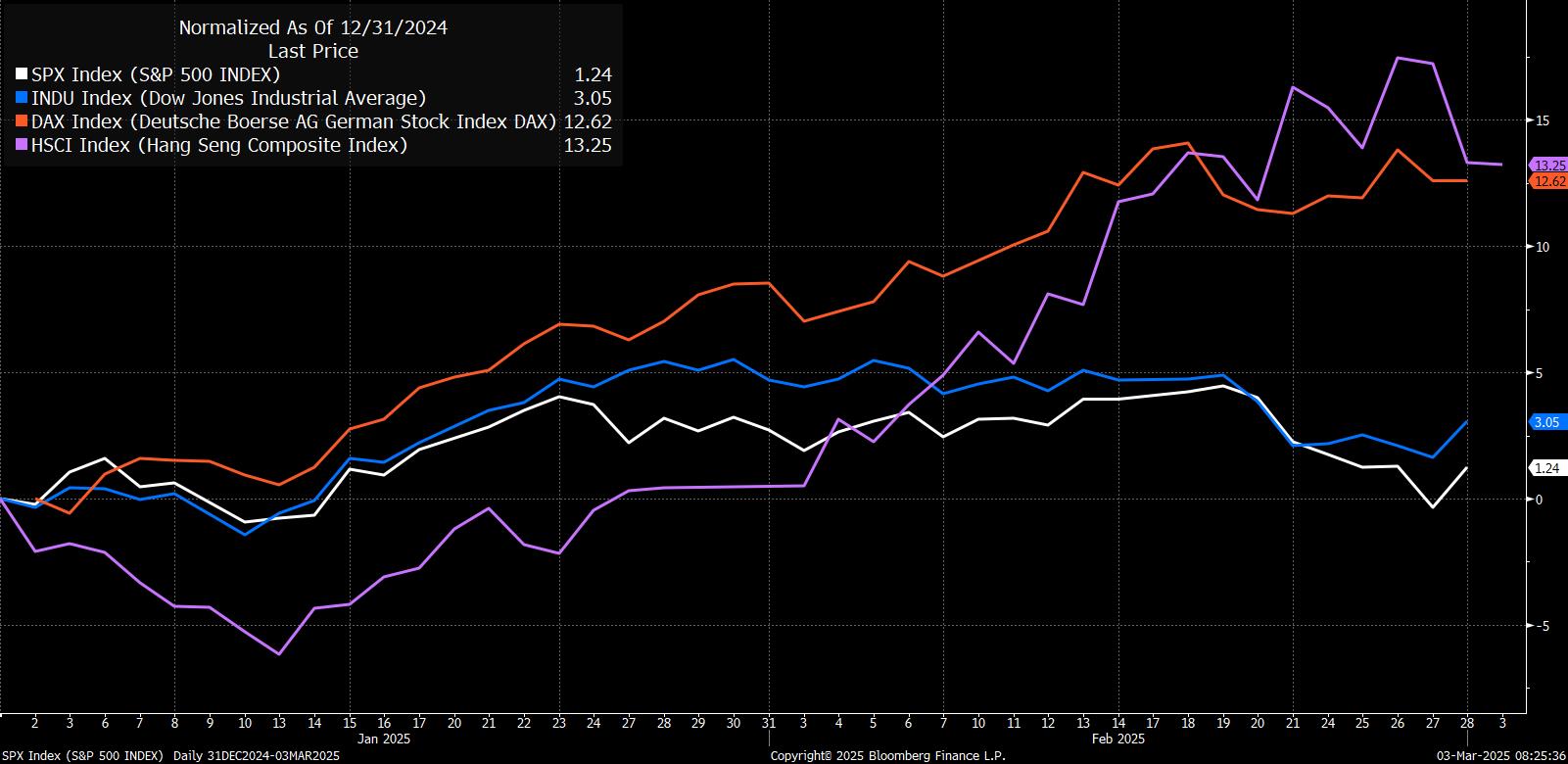

Indices’ performance YTD (source: Bloomberg)

Events Watchlist:

-

Tue, March 4th: Trump speech before Congress; deadline for US tariffs against Canada, Mexico, China

The US30 (Dow) index is the only major US stock index that still has a year–to–date gain (1.6%) compared to the US500 (S&P 500) and the NAS100 (Nasdaq 100) which have erased all their 2025 gains at the time of writing. Given the economically sensitive nature of the US30 index’s members, greater fears of a global trade war could further erode that 1.6% figure, potentially pushing the US30 below the 43,000 level.

-

Wed, March 5th: China's National People's Congress; report due on China's 2025 growth target

At the time of writing, the tech–heavy CHINAH stock index has a remarkable year–to–date gain of 15.5%, thanks to a period of world–beating gains fuelled by the DeepSeek–mania, which lifted Chinese AI and tech stocks. If Beijing announces further stimulus for the world’s second–biggest economy, perhaps to offset any escalations in trade tensions, that could see the CHINAH touching the 9,000 mark for the first time since November 2021.

-

Thur, March 6th: European Central Bank (ECB) rate decision

Like the CHINAH and the HK50, the GER40 also boasts a double–digit (almost 13% at the time of writing) advance so far this year. Although another 25–basis point rate cut is already widely expected in March, the GER40 could set a new record high above 23k if the ECB solidifies hopes for a further 75–bps in cuts over the next 3 quarters.

-

Fri, March 7th: US nonfarm payrolls (NFP); speech by Fed Chair Jerome Powell

Economists predict that 158,000 new jobs were added to the US economy in February, with the unemployment rate rooted at 4%. A “goldilocks” NFP report could help ease US economic concerns and restore the US500 closer to the 6,000 mark. Beyond a technical rebound, this benchmark US stock index could also recover on a weaker–than–expected set of US jobs data, provided Chair Powell suggests a sooner–than–later Fed rate cut.

Here’s a comprehensive list of other key economic data and events due this week:

Monday, March 3

- AUD: February Melbourne Institute Inflation

- CN50 index: China February manufacturing PMI

- GER40 index: Eurozone February CPI

- Global February PMIs (final)

- US30 index: US February ISM manufacturing; speech by St. Louis Fed President Alberto Musalem

Tuesday, March 4

- JPY: Japan January jobless rate

- AU200 index: RBA meeting minutes; January retail sales

- EU50 index: Eurozone January unemployment

- US500 index: President Trump’s speech before Congress

- US tariffs set to be imposed on China, Canada, Mexico

Wednesday, March 5

- AUD: Australia 4Q GDP

- CNH: China February services, composite PMIs

- CHINAH index: China 2025 growth target report

- SG20 index: Singapore February PMI; January retail sales

- RUS2000 index: Fed Beige Book; US February ISM services index; January factory orders

Thursday, March 6

- AUD: Australia January trade balance

- EUR: ECB rate decision; Eurozone January retail sales

- RUS2000 index: US initial weekly jobless claims; 4Q GDP (second est.)

- USDInd: Speeches by Fed Governor Christopher Waller, Atlanta Fed President Raphael Bostic

Friday, March 7

- Trump's crypto summit

- CNH: China February trade balance

- TWN index: Taiwan February trade balance, CPI

- GER40 index: Germany January factory orders; Eurozone 4Q GDP, employment (final)

- US500 index: US February nonfarm payrolls

- USDInd: Speeches by Fed Chair Jerome Powell, New York Fed President John Williams, Fed Governor Michelle Bowman

- CAD: Canada February employment

Ready to trade with real money?

Open accountGateway to global opportunity

Join more than 1 million traders worldwide using Alpari as a gateway to a better life.